Declaration of trusts: A parents' guide

> What is a declaration of trust?

> Reasons you need a declaration of trust

> Talking to your children about a declaration of trust

> What’s included in the declaration

> Additional considerations for the Bank of Mum and Dad

> Tenants in common and joint tenants

> Changing a declaration of trust

If you’re giving or lending money to your children to help them get on the property ladder, you might want to protect your investment – especially if they’re buying with a partner. A declaration of trust is an easy way of doing this, by legally stating who owns what.

A declaration of trust is a legal document which outlines the financial agreements between everyone who has an interest in the house. It’s also called a deed of trust. People tend to get them when they’re buying a house and want to protect their different financial investments in the property.

This is relevant to parents who are helping their children to get on the property ladder by gifting all or some of the deposit.

It’s not cheap to buy a house. Many people can afford it by pooling their resources and buying with a friend or partner. As such, it’s common for these people to pay different amounts towards the deposit and/or mortgage. This could add up to a lot of money.

The purpose of a declaration of trust is to protect everyone’s money. It outlines exactly what would happen if the relationship between partners or friends broke down, and the house needed to be sold or one person wanted to buy the other out.

The legally-binding document will make sure everyone involved gets what they’re entitled to. For example, if you gave your child enough money to pay for their entire deposit, a declaration of trust could ensure they got that back if the relationship broke down. This agreement is typically made when the property is purchased.

To put it simply:

- Without a declaration of trust. The sale of a house wouldn’t reflect different financial interests. How much should be repaid to everyone involved wouldn’t be clear, especially for unmarried couples.

- With a declaration of trust. Everyone’s shares will be set out. This is what would be used to decide how to distribute the proceeds of a house sale, or how much would be needed to buy someone out.

Not only will it record whether one person has put in more money at the start, it can also document the intentions for making mortgage repayments and/or contributions to the the financial upkeep of the property.

For parents, it’s not a statement on whether you think your child’s relationship will work. It’s just a practical way of preparing for the possibility the house – a huge asset – would need to be divided up for some reason. You can also use a declaration of trust to set out the circumstances in which the money you provided should be repaid.

Even if you’re not helping them out with a deposit, it’s worth explaining their options. A declaration of trust will:

- Set out how much each person has put in

- Let them know what should happen in any eventuality

- Reduce the chance of disagreements down the line

A declaration of trust is the obvious choice for many people buying a house together. But when you’re swept up in the excitement, it can seem a bit of a downer to think about what would happen if things went wrong. It can be a tricky thing to raise with your children.

Rather than thinking of it as being pessimistic, discuss it as a practical thing to do when buying a house. There are plenty of persuasive reasons for doing so too. For example, if your child and their partner are unmarried, the same legal protection that married couples get doesn’t apply if they split up.

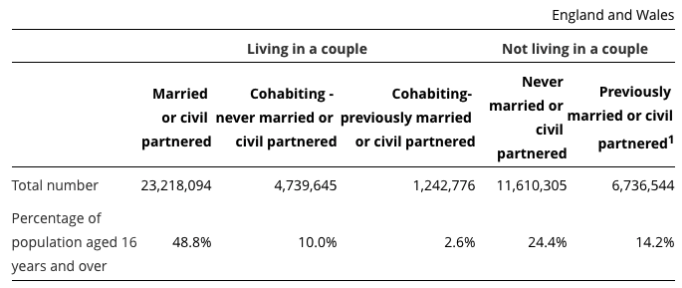

And it’s something that’s relevant to many people. Living in a couple continues to be the most popular living arrangement in England and Wales, with around 1 in 10 people were living in a couple having never been married or civil partnered.

Source: Office of National Statistics

In these situations, there’s no guarantee everyone will get what they’re entitled to. If you couldn’t agree on the ownership of the house, without common spouse law, the courts will ‘infer’ your intentions at the start. And when money is involved, things can get messy. A declaration of trust can prevent that.

Some parents make it a condition of their financial support, but the best thing to do is to talk to your kids. You can always get advice from your conveyancing solicitor too.

When you’re buying a house, your conveyancing solicitor should bring up declaration of trusts. It might be the first you’ve heard of it, so do take the time to consider what’s right for you.

As part of the conveyancing process, house buyers who are using a declaration of trust have to tick a box on the Land Registry form (TR1). It clarifies how much of the property each person owns. The options are:

a) Joint tenants

b) Tenants in common with equal shares in the property

c) Tenants in common with shares as set out in the agreement

When you buy a house with someone else, you either own it as tenants in common or joint tenants. Here’s the difference:

- Joint tenants. In the eyes of the law, you own the property equally (unless otherwise stated). As such, you can’t leave your share to anyone else in your will – if one of you passes away, the share goes to the other owner.

- Tenants in common. You each own a share of the property (which could be equal or not), but it would not automatically go to the other owner if you passed away. It would be passed on as set out in your will, or under intestacy rules.

Declaration of trusts can be used in both types of property ownership. For tenants in common, the reasons are more obvious. You could have paid different amounts towards the deposit, and plan to pay different amounts towards the mortgage, so that should be reflected in your shares in the property.

But it’s also an important document for joint tenants. It can be used to record respective contributions to the cost of a house and ongoing costs, and protect both buyer’s beneficial interests. This is done with a voluntary joint owners form, introduced in 2012, to the Land Registry form your solicitor will ensure you complete.

Also, not many people know that without one, either joint owner can sever the joint tenancy agreement. All they have to do is serve written notice on the other co-owner. They don’t need to tell this person beforehand, nor do they need their permission.

This means one owner could get a Notice of Severance, automatically changing ownership to the tenants in common type, without the other person knowing. Although this isn’t recommended, it could happen and would mean one owner could change who they wanted to leave their share of the property to. A declaration of trust can be used to set out how the joint tenancy can be severed.

Always discuss what you want the document to include, because agreements can be as complex – or as simple – as you need.

The purpose of a declaration of trust is to make sure everyone gets a fair portion of what they put into the property. So, as a basic requirement, the document should set out what each person contributes. This includes:

- How much each person paid towards the deposit

- The portions of the mortgage each person will pay

- How much each person pays towards other outgoings e.g. utilities

- An agreed way of buying each other out

- An agreed way of valuing the house

- How the proceeds of a sale would be split, based on the shares owned by each person

- An agreement on what happens if the property value increases or decreases, and the risks to each person’s shares

In terms of complexity, declaration of trusts vary. Some documents will include details on many possible scenarios; others will just agree a percentage split of who owns what. It’s very much based on what the couple need. For example, you could include an agreement to enable any children to stay in the house. You could also get the declaration re-written if circumstances change – for example, if you had kids later on.

With your solicitor, you can discuss how equitable interest would be treated. After all, property prices do change. If your house has increases in value, you might want that recognised in your share.

It’s important to recognise that a declaration of trust doesn’t include anything about your obligations to your mortgage provider. They remain separate. This means both of you will be responsible for making the monthly repayments, unless you organise a new arrangement with the provider. If one of you fails to pay the mortgage, the other is responsible.

A declaration of trust can also be used to record what support is given by parents. The most obvious reason is that if you give money to your kids for a house, and they then split up with the partner they bought with, you typically wouldn’t want them to get any of that money.

If you gift money, you could use the declaration to say if a split happened the money would go back to you or your child, but not the partner. The remaining equity would be divided after this amount was removed. It’s also advisable for parents to get a Deed of Gift prepared to confirm the money is a gift, not a loan.

If you’re loaning the money to your child, you might want to use a declaration to say you own a share, or the agreement for paying that loan back. Bear in mind this might make it trickier for them to get their mortgage approved.

Example (without parental support)

A couple buy a house together worth £300,000 – person A invests £40,000 and person B invests £10,000 towards the deposit. They get a mortgage for £250,000.

They use a declaration of trust to declare person A owns an 80% share and person B owns 20%. This includes any gain or loss on sale of the house. They also use their declaration to say they’ll share mortgage repayments equally. Over time, their shares in the property won’t change.

Example (with parental support)

A couple buy a house together worth £400,000 – person A invests £30,000 in the deposit, and person B provides £20,000. They get a mortgage for £300,000, and one parent also provided £50,000 towards the deposit.

They use a declaration of trust to protect the parent’s interest. When the property is sold, after the mortgage and other associated costs, that contribution would be paid back first. They then agree to split the remaining value up to £400,000 – 60% to person A, and 40% to person B. Any increase in value would be split 50:50, as they are paying equal amounts to the mortgage and bills.

Although typically part of the conveyancing process, a declaration of trust won’t always be included in your initial quote from a solicitor. Make sure you specify you need one so it can be included for an accurate price. At Manak Solicitors, prices start from £350 plus VAT.

Circumstances change over time. Someone might lose a job, get ill or have a change in income. Typically a declaration of trust doesn’t account for these changes where one person may have to cover more of the mortgage for a long time. You might want to change the declaration to account for this.

Other reasons to change the document could be if you’ve improved or extended the property and increased its value, but only one person paid for the developments. That person would be entitled to more of this additional value.

Depending on how big these changes are, you might have to get the declaration re-written.

You’ll also need to bear in mind if you get married then section 25 of the Matrimonial Causes Act 1973 applies. The principles included within this deal with how property should be divided if the marriage breaks down. This doesn’t make the declaration of trust invalid, and if there are provisions about what should happen if you marry within the document, they will be relevant. But the courts would not see the declaration as conclusive.

That’s why many people get a prenuptial agreement too, including the same – or updated – provisions as the the declaration of trust. It increases the chances the agreement will be upheld if you get divorced.

A declaration of trust is designed to set out financial agreements from the outset. That’s why it’s typically used at the start of a house purchase, so that everyone involved is protected from the start. This is the ideal situation. But you can get a declaration of trust written later down the line. The most important thing is that it represents an agreement between all parties.

For example, if one person inherited a substantial amount of money and wanted to use some of it to pay off the money, they might want this additional contribution legally recognised. If both people agreed, a declaration of trust could be written, even years after the initial purchase.

Useful links

Joint property ownership

https://www.gov.uk/joint-property-ownership

Tenants in common vs joint tenancy

Legal estates and beneficial interests: what’s the difference?

https://hmlandregistry.blog.gov.uk/2016/08/16/legal-estates-beneficial-interests-whats-difference/

Declarations of trust

Declaration of trust definition

https://www.investopedia.com/terms/d/declaration-of-trust.asp

Do we need a deed of trust to reflect our shares in our house purchase?

We want to lend our son money to buy a house with his girlfriend but they fall out all the time: How do we protect our cash in case they break up for good?

My ex won’t honour the declaration of trust we signed for our mortgage

https://www.theguardian.com/money/2014/jun/26/honour-declaration-of-trust-house